means the fictional character, as featured in and depicted on pages of the Style Guidelines Business Day.

Agreement: 1 Definitions and interpretation 1.1 In this Agreement: Assets

/white-measuring-tape-on-arm-516451722-a7d5f49c18474497aef1d18b9f12a9e2.jpg)

(C) The Licensor has agreed to grant a licence to the Licensee to use the trade marks on the terms and conditions of this Agreement. Background (A) The Licensor is the proprietor of certain trade marks relating to the famous fictional character as featured in. View the related precedents about Arm’s length transaction Character merchandising agreement-pro-licenseeĬharacter merchandising agreement-pro-licensee This Agreement is made on Parties 1, a company incorporated in England and Wales, whose registered number is and whose registered office is at (Licensor) and 2, a company incorporated in England and Wales, whose registered number is, whose registered office is at (Licensee) (each of the Licensor and the Licensee being a party and together the Licensor and the Licensee are the parties).

tax charges are generally imposed on both the recipient and the scheme, although individuals and companies can apply to HMRC for relief from the tax charges in certain circumstances.

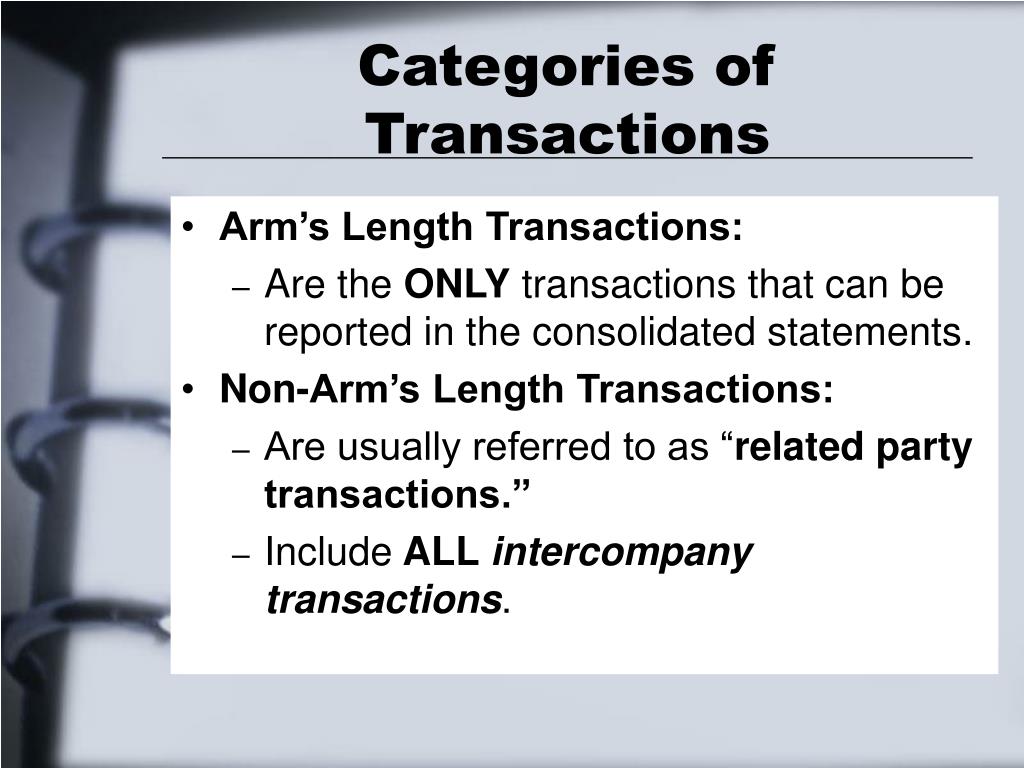

DEFINITION OF AN ARMS LENGTH TRANSACTION REGISTRATION

For information on the registration requirements, see Practice Note: Registration of pension schemes.To the extent that an unauthorised payment arises: Importantly, as part of this, the scheme must confirm that the ‘instruments or agreements’ by which the pension scheme is established do not entitle any person to unauthorised payments. Among other things, on registration, the scheme administrator must confirm that the pension scheme meets all the criteria to be registered as a pension scheme under the Finance Act 2004 (FA 2004). For members, a registered pension scheme represents a tax efficient investment vehicle to provide for an income in retirement subject to HMRC’s annual and lifetime allowances.A UK registered pension scheme must satisfy certain conditions. Broadly, this means that any income and gains arising in the hands of the UK registered pension scheme on its investment activities is exempt from UK taxation. View the related practice notes about Arm’s length transaction Authorised and unauthorised paymentsĪuthorised payments v unauthorised paymentsA pension scheme that has registered with HMRC benefits from favourable UK tax treatment.

0 kommentar(er)

0 kommentar(er)